LightCounting releases a research note on the Nokia/Infinera deal

Time: 2024-07-11

Nokia announced on June 27, 2024, that it had reached an agreement to acquire Infinera for $2.3 billion, with the deal expected to close in the first half of 2025. The deal will give Nokia’s optical networking group access to some new products with significant design wins, and will expand Nokia’s access in the North American market, while better supporting Infinera’s customers outside of North America. Financially, the deal could increase Nokia’s optical networking sales by as much as 80% in 2025, more than doubling Nokia’s share of coherent DWDM port shipments and bringing it closer in size to segment leader Ciena.

Nokia’s announcement comes days after the sale of its submarine business to the French government, so it seems part of a larger refocusing on core strengths and higher-growth areas. Nokia has had competitive long-haul coherent optics in terms of performance but has failed to get much traction outside its traditional telecom markets. Infinera has recently announced design wins for 800G ZR/ZR+ for the Data Center Interconnect (DCI) market and bidirectional 400G ICE-X pluggables for the MSO segment, and it valued both opportunities at several hundred million dollars.

With the Infinera deal Nokia will gain access to the faster-growing DCI market and a pluggable coherent product line with a strong order pipeline. Cisco (Acacia) and Marvell dominate the market for pluggable coherent 400ZR/ZR+ modules, shipping since 2022. We expect that shipments of 800ZR/ZR+ will start in 2025 and Infinera/Nokia is well positioned to take a sizable share of this business. Ciena, Fujitsu, ZTE and a long list of smaller companies also target the 800ZR/ZR+ segment. North American cloud companies are diversifying their supply chains in order to avoid potential disruptions. We expect more vendors to be successful getting a share of 800ZR/ZR+ business, in contrast to the duopoly of Cisco and Marvell in 400ZR/ZR+.

In terms of networking equipment revenues, Nokia is a Tier 1 player, on the same scale as Cisco, Ericsson, Huawei, and ZTE, with about an 11% share of global annual sales in 2023. This includes all the different divisions of the Nokia Networks group, within which Mobile Networks accounted for 54% of 2023 sales, Fixed Networks for 13%, IP Networks for 15%, Optical Networks for 11%, and Submarine for 6%. Nokia’s Optical Networks business posted just over $2 billion in sales in 2023, while Infinera reported $1.6 billion in 2023 sales overall. Accordingly, adding Infinera’s revenues will increase Nokia’s optical networking sales by 80% and move those combined sales much closer to (though still smaller than) their nearest competitor Ciena, which recorded 2023 sales of $4.3 billion.

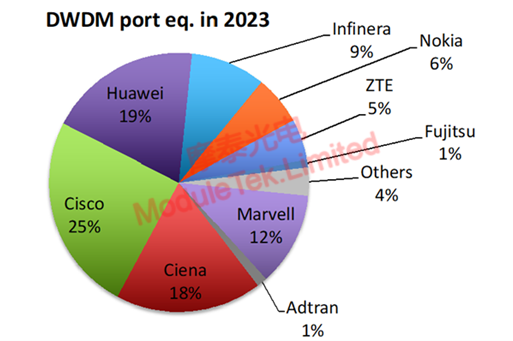

Figure 1 Market share of coherent DWDM ports shipped in 2023

The figure above shows 2023 shares of coherent DWDM port shipments, measured in 100G equivalents (400G counts as 4, 800G counts as 8, etc.). This chart reveals an even greater motivation for Nokia to acquire Infinera: the merger would move Nokia from being a Tier 2 player in the coherent optical transport space to a Tier 1 player, closer in scale to Ciena, Cisco, Huawei, and Marvell.

40G/100G Optical Transceivers

40G/100G Optical Transceivers 10G/25G Optical Transceivers

10G/25G Optical Transceivers 155M/622M/2.5G Optical Transceivers

155M/622M/2.5G Optical Transceivers 100M/1G Optical Transceivers

100M/1G Optical Transceivers FC 16G/32G Optical Transceivers

FC 16G/32G Optical Transceivers CWDM/DWDM Optical Transceivers

CWDM/DWDM Optical Transceivers 100M/1G/10G Coppers

100M/1G/10G Coppers Active Cable AOC

Active Cable AOC Direct Attach Cable DAC

Direct Attach Cable DAC Regular/MTP-MPO Fiber Patch Cords

Regular/MTP-MPO Fiber Patch Cords MT2011

MT2011 MT2010

MT2010 CodingBox

CodingBox